Financial independence—the dream of having your money work for you, instead of you working for money—is achieved through smart, long-term investing. It’s not about being rich overnight; it’s about building a dependable machine that generates wealth over time.

For beginners, the stock market often seems like a complicated, risky game. The truth? It is the single most effective vehicle for compounding wealth. You just need a simple, disciplined strategy.

Here is your beginner’s blueprint to launching your investment journey and securing financial freedom.

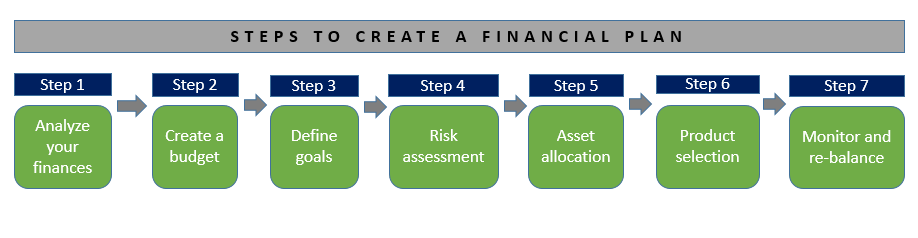

1. Set Your Financial Foundation (Before You Invest)

Before you put a single rupee into the market, you must ensure your basic finances are stable. This acts as a safety net against market volatility.

- Kill High-Interest Debt: Prioritize paying off expensive debt like credit cards or high-interest personal loans. The guaranteed return from avoiding 18-30% interest is the best return you will ever get.

- Establish an Emergency Fund: Keep at least 3 to 6 months’ worth of living expenses in an easily accessible, liquid account (like a high-yield savings account). This prevents you from being forced to sell your investments at a loss when an unexpected expense arises.

- Define Your Goals: Why are you investing? (e.g., Retirement in 30 years, Child’s education in 10 years). Your timeline determines the risk you can afford to take. For long-term goals (10+ years), you can afford more risk.

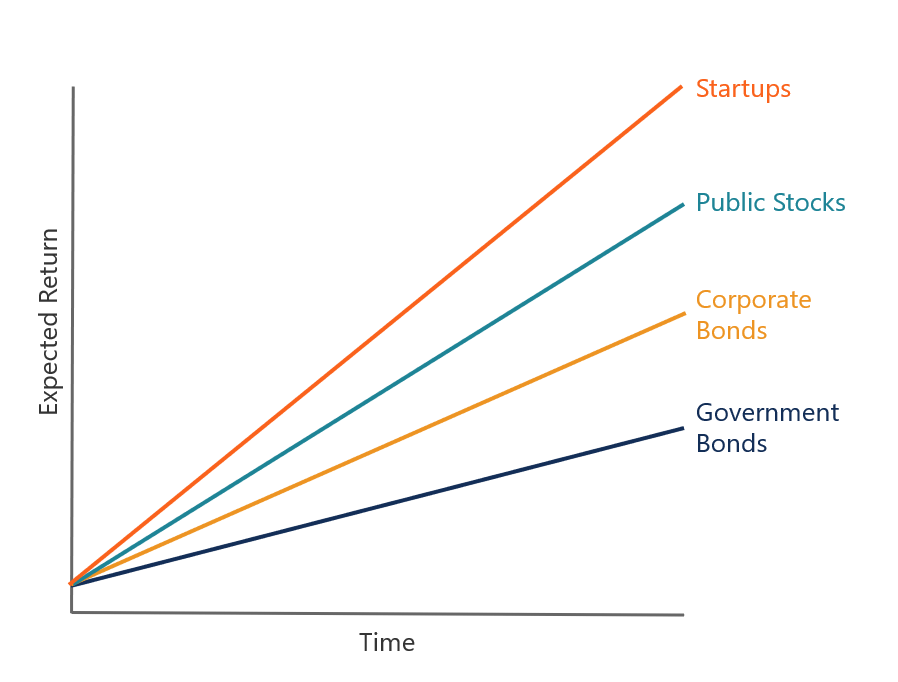

2. Master the Core Concepts: Risk vs. Time

The two most powerful forces in investing are compounding and patience.

A. The Magic of Compounding Interest

Compounding is earning returns on your initial investment plus the returns you earned previously. Starting early means your money has more time to grow exponentially.

Example: A person who invests $2,000 annually from age 25 to 35 (only 10 years) will likely have more money by age 65 than a person who starts at age 35 and invests $2,000 annually until age 65. Time is your most valuable asset.

B. Long-Term Mindset

The stock market is prone to ups and downs (volatility). A true investor focuses on owning a piece of great companies for the long run. Ignore the daily news noise and focus on your decades-long goal. Don’t panic and sell during a market drop—that’s when you should consider buying more.

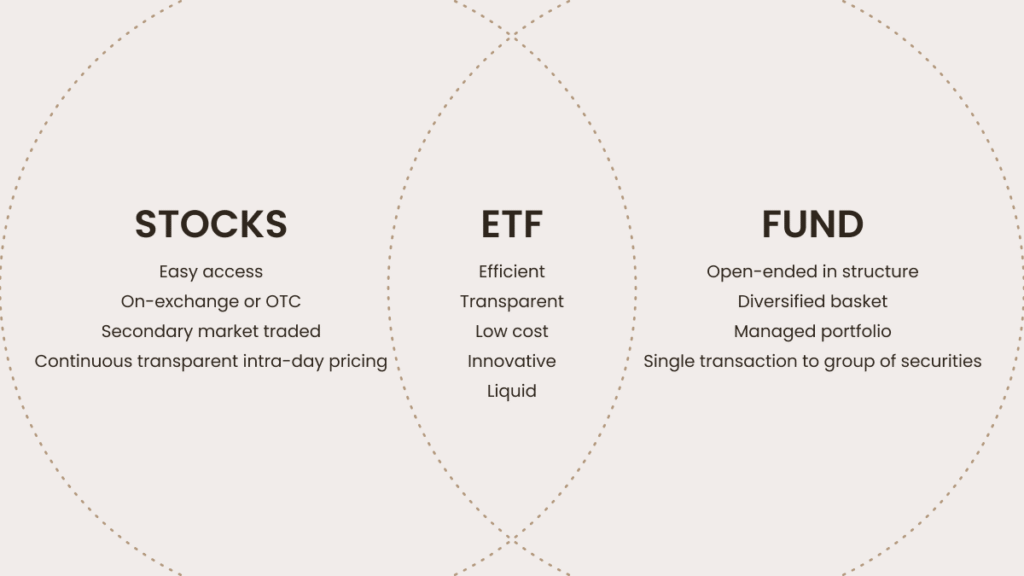

3. Choose Your Investment Vehicle (How to Invest)

As a beginner, you should focus on diversification and low costs. Do not attempt to pick individual stocks right away.

The Beginner’s Best Friend: Index Funds & ETFs

- What they are: An Index Fund (or ETF) is an investment that tracks a broad market index, such as the S&P 500 (USA) or Nifty 50 (India). When you buy this fund, you are instantly buying a tiny piece of hundreds of top companies.

- Why they work: They offer instant diversification, minimizing the risk that a single company failure could wipe out your portfolio. They are low-cost, and historically, these broad market funds have outperformed most professional fund managers over the long term.

Actionable Step: Open a Brokerage Account

You will need an account to buy these funds. Research reliable online brokerage platforms (Demat accounts in India). Look for brokers that offer low or zero commission fees on stock and ETF trades.

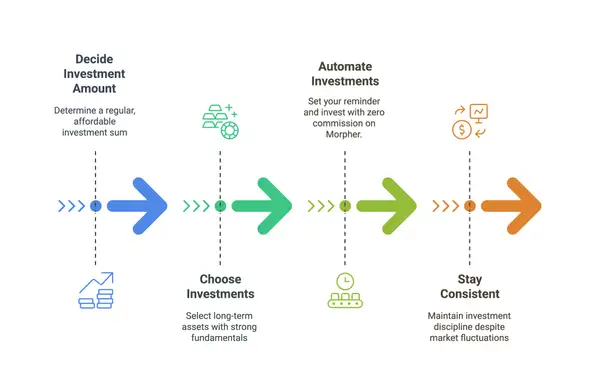

4. Automate Your Discipline with DCA

The simplest and most effective strategy for beginners is Dollar-Cost Averaging (DCA).

- The Strategy: You invest a fixed, consistent amount of money at regular intervals (monthly, weekly), regardless of whether the market price is high or low.

- The Benefit: This removes emotion from investing. When prices are high, you buy fewer shares; when prices are low, you automatically buy more shares. Over time, your average purchase price is stabilized, leading to better returns than trying to guess the “perfect time” to invest.

- How to Do It: Set up an Automated Transfer (SIP in India) from your bank account to your brokerage account every month, just after you get paid. Pay yourself first!

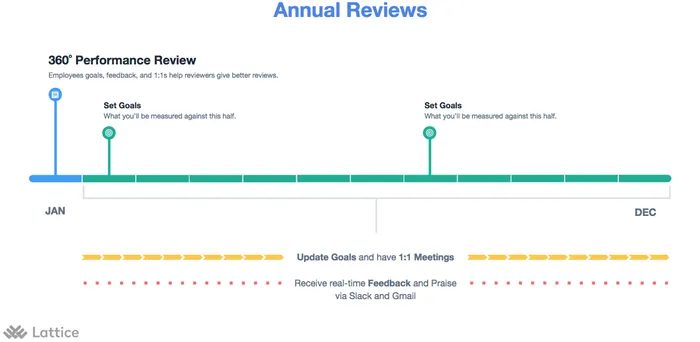

5. Review, Rebalance, and Keep Learning

Investing isn’t a “set-it-and-forget-it” process entirely; it requires occasional checks.

- Review Annually: Once a year, review your portfolio to ensure your investments still align with your goals and risk tolerance.

- Rebalance (If Needed): If the stock portion of your portfolio has grown too large (e.g., now 80% when you planned for 70%), you might sell a small portion of the stock and move it into lower-risk assets like bonds to bring the portfolio back into balance.

By following these simple, disciplined steps, you utilize the power of compounding and time to put your money on the path to true financial freedom.

Your Action Plan for Stock Market Investing

This table breaks down the process for beginners, highlighting the essential steps, the underlying reasons (The Why), and the recommended tools for achieving Financial Independence.

| Phase | Key Step | The Why (Rationale) | Beginner’s Investment Vehicle |

| 1. Preparation | Clear High-Interest Debt & Build an Emergency Fund | High-interest debt guarantees negative returns. An Emergency Fund prevents you from being forced to sell investments during market lows or crises. | High-Yield Savings Account (For liquidity) |

| 2. Foundations | Understand the Power of Compounding | This is the most powerful wealth-building engine. Starting Early is crucial as your returns generate further returns over decades. | Time (Your greatest asset) |

| 3. Platform | Open a Brokerage/Demat Account | This is your entry gateway to the market. Choose a platform with low/zero commissions and a user-friendly interface. | Reputable Online Brokerage |

| 4. Strategy | Start with Broad Index Funds or ETFs | This strategy provides instant diversification, minimizing the risk of a single company failing. Historically, the broad market outperforms most active managers. | Index Funds/ETFs Tracking Major Benchmarks (e.g., S&P 500, Nifty 50) |

| 5. Discipline | Implement Dollar-Cost Averaging (DCA) | Invest a fixed, consistent amount regularly, regardless of market conditions. This removes emotion and ensures you buy more shares when prices are low. | SIP (Systematic Investment Plan) / Automated Monthly Transfer |

| 6. Longevity | Ignore Market Volatility and Stay Invested | Financial independence is a long-term goal (10+ years). You must be prepared to weather inevitable market downturns. | Patience |

#FinancialFreedom #Investing#StockMarket#PersonalFinance#WealthBuilding#MoneyManagement#BeginnerInvestor#InvestSmart#StockMarketForBeginners

#FinancialLiteracy#PassiveIncome#ETFs#IndexFunds